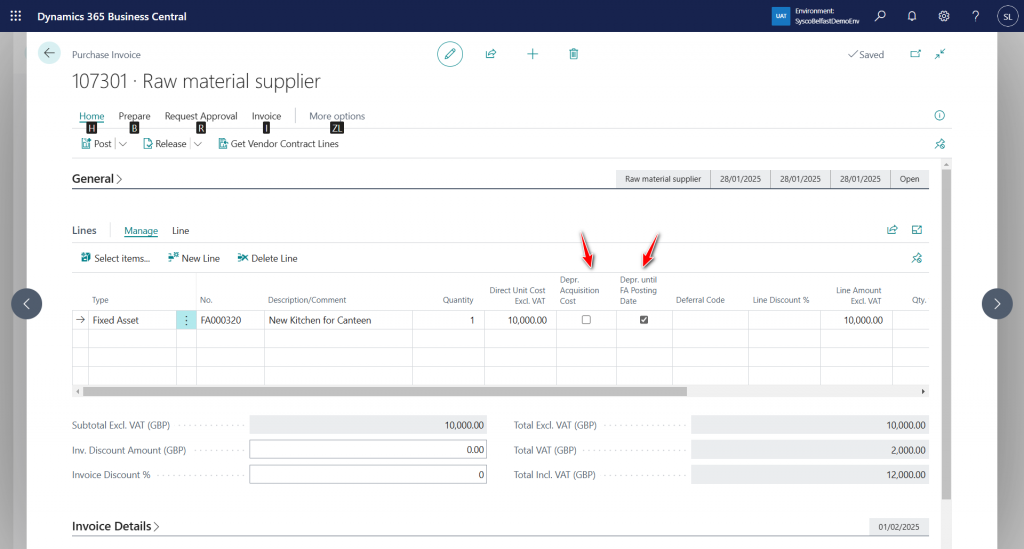

Ok, so maybe I am not alone here but there are two fields on the purchase invoice subpage that I am not familiar with and thought I should investigate. The fields I am referring to are referenced below.

Take the Depr. Acquisition Cost field first and try to work through an example. When I researched this field I discovered that this related to an asset that has already had depreciation calculated. Here is the related link.

https://learn.microsoft.com/en-gb/dynamics365/business-central/fa-how-revalue

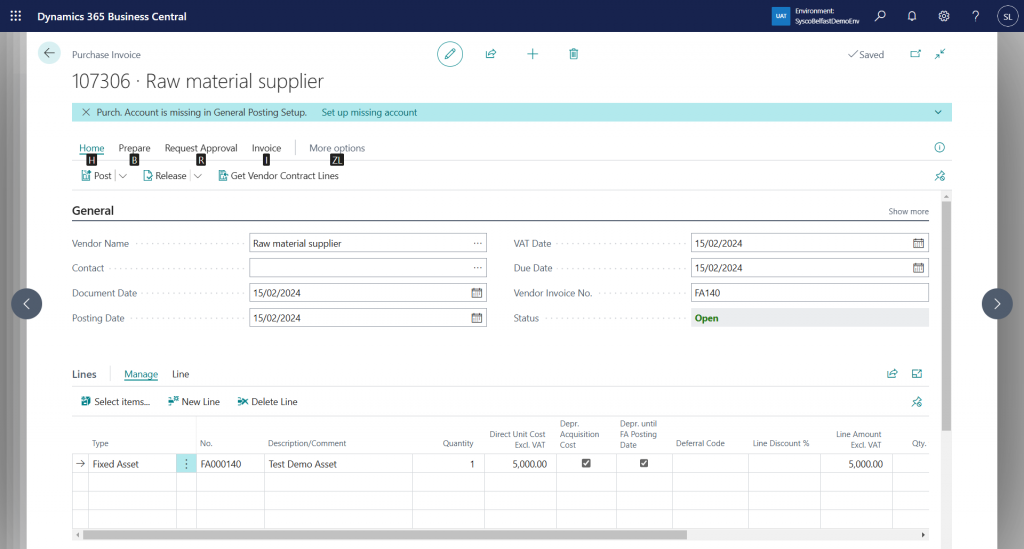

Using this fixed asset, post a second purchase invoice for this asset but this time make sure to tick our new field.

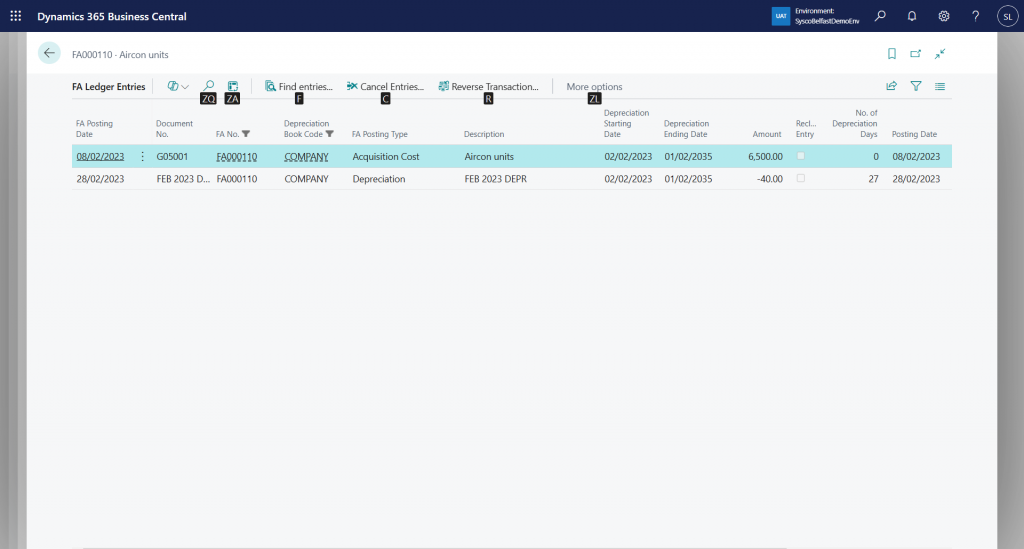

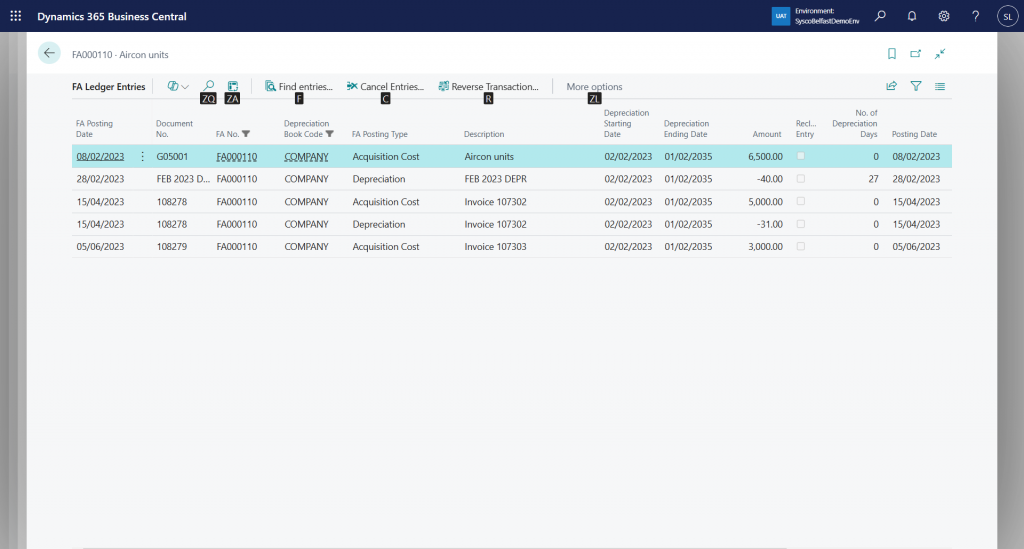

Notice the posting dates that have been added unto the purchase invoice as we can follow these through to the fixed asset ledger entry.

The depreciation start and end dates of the new purchase invoice are aligned with the original purchase invoice and a second line has also been created for depreciation. The depreciation calculated is now based on the total acquisition cost. Depreciation was calculated up to 28/02/23 which was a total of 27 days with 4355 days remaining. Using straight line depreciation (27/4355) * 11,500 = 71.30.

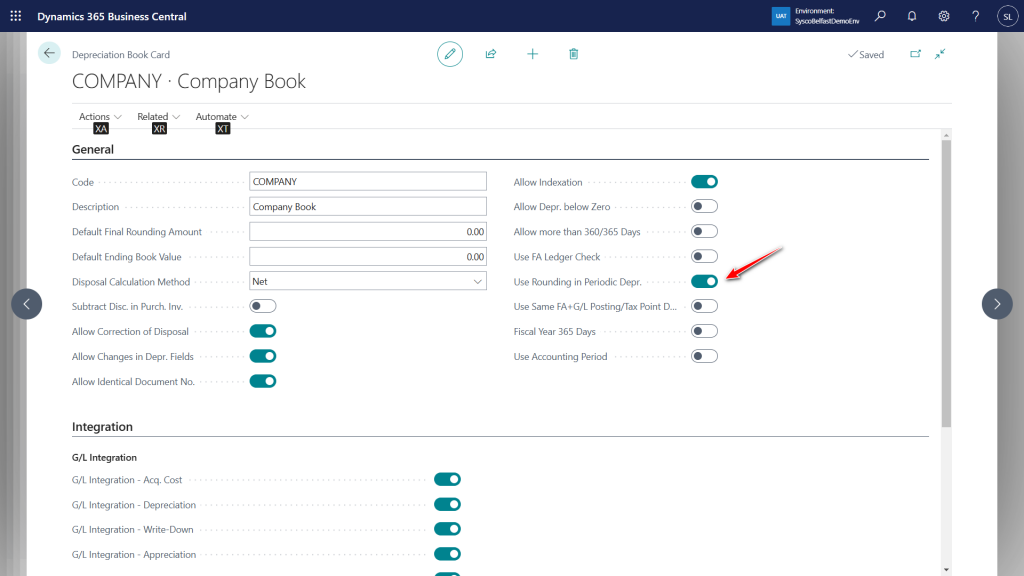

As there was already depreciation calculated for £40 then the difference is 31.30. My entry was rounded to 31 based on the depreciation book setting.

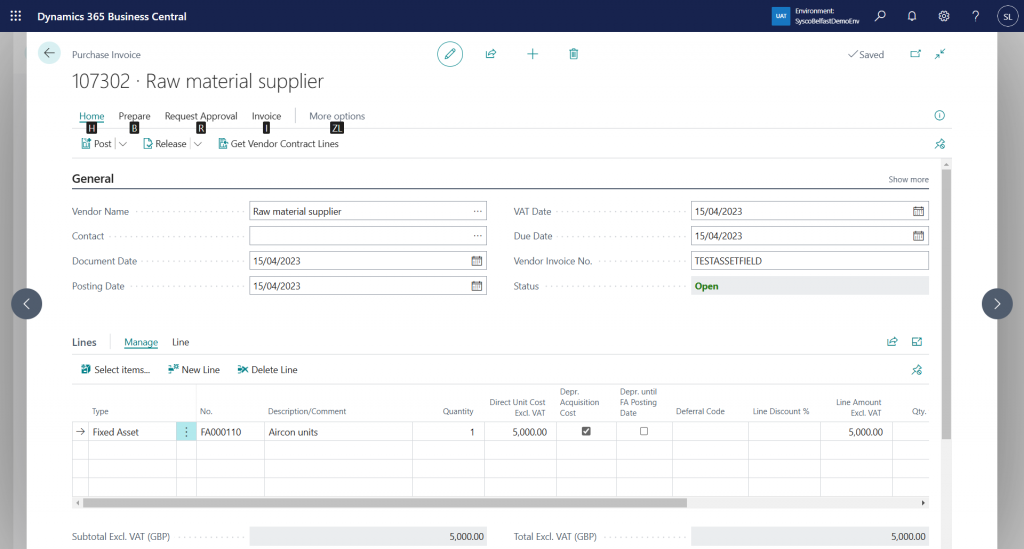

What would have happened if the field was not ticked when posting the purchase invoice. See below where a third cost was posted but this time the boolean was not set on the purchase invoice.

No depreciation has been calculated so remember to select the Depr. until FA Posting Date checkbox on the invoice, the fixed asset G/L journal, or the fixed asset journal lines to ensure that depreciation is calculated from the last fixed asset posting date to the posting date of the other acquisition cost.

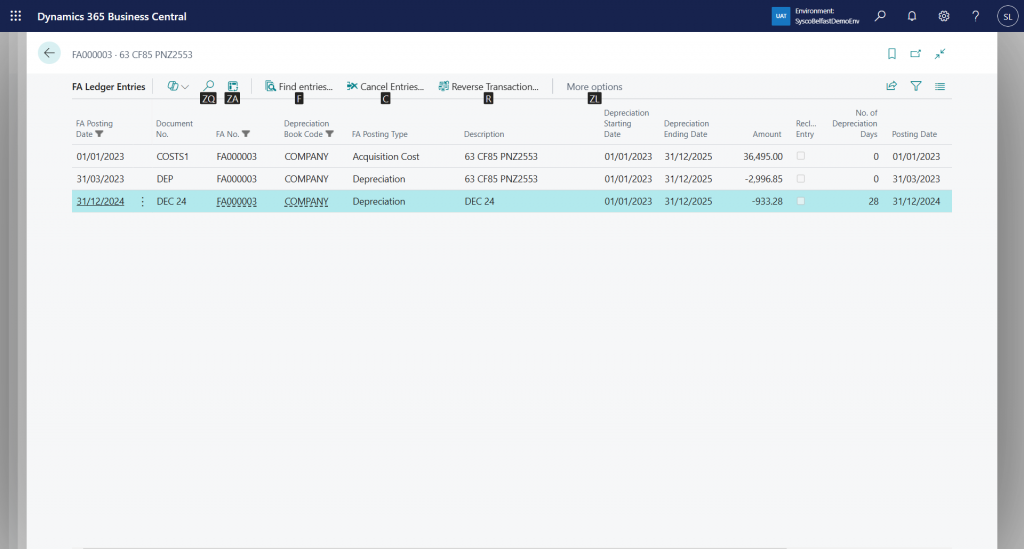

So why does our second field do, Depr. Until FA Posting Date. Taking another asset with an acquisition cost and depreciation already calculated.

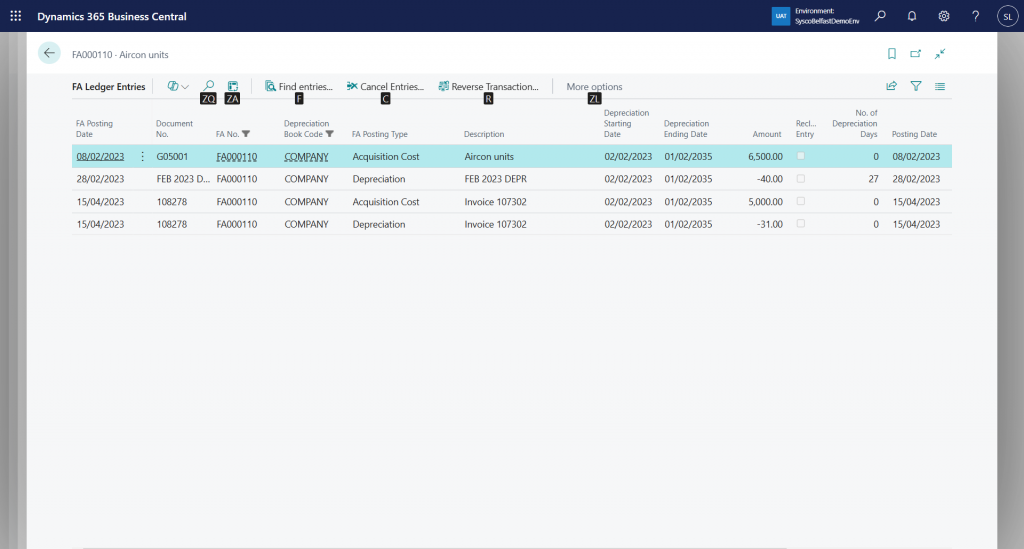

Post the purchase invoice as shown and then check the fixed asset ledger entries.

This time depreciation has been calculated on the current book value from the last depreciation to the latest acquisition cost.

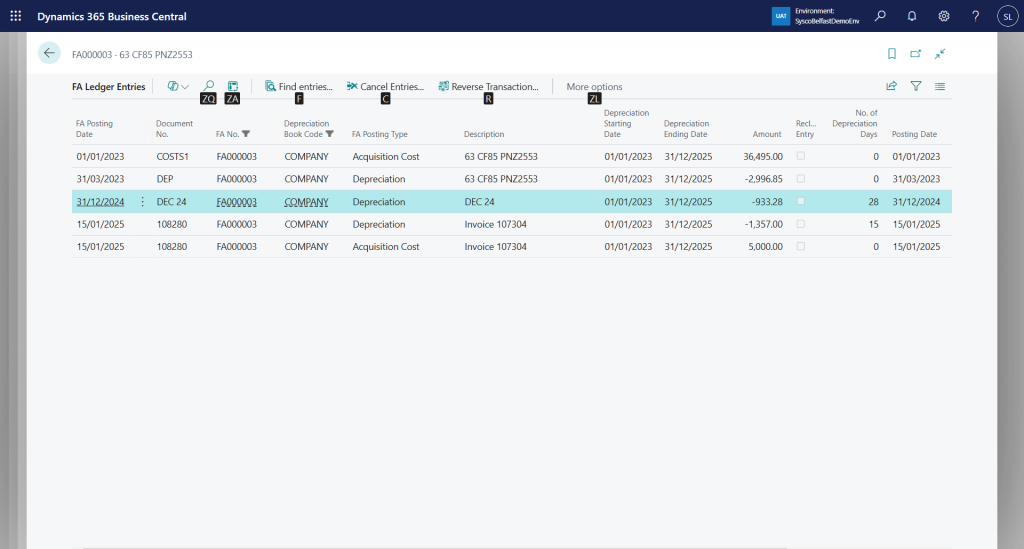

Can both fields be ticked?

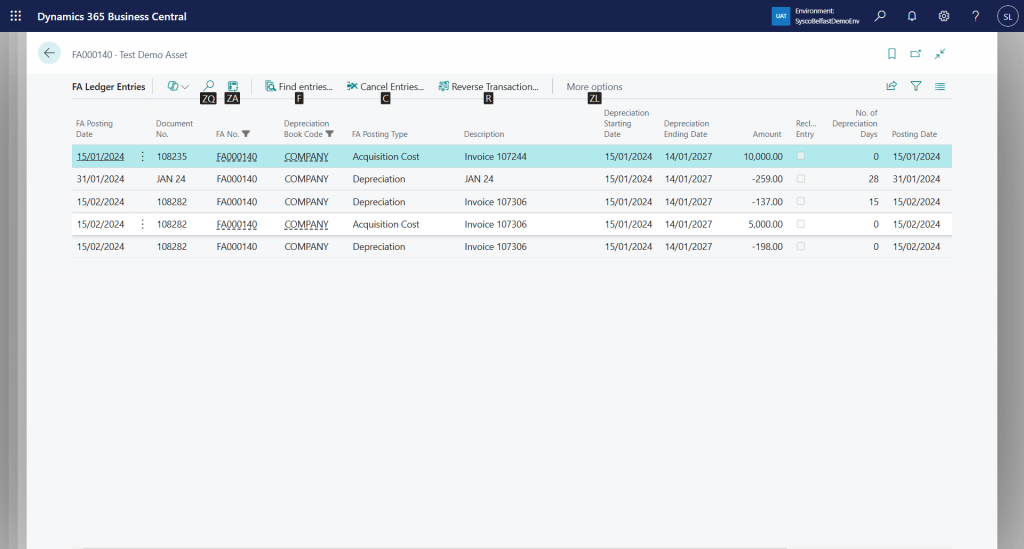

Once posted then the fixed asset ledger entries will be updated as below.

Depreciation is calculated for 15 days based on the current net book value, the additional cost is then posted and the third entry posted is the difference in depreciation based on the new cost. For example, 137 has been calculated as NBV(9741) * Deprec Days(15) / Remaining Days(1064)

Then similar to the first example depreciation is calculated for the new cost to keep the net book value aligned.

Hopefully, that shines some light on the topic but I will be investigating further and will update.

Thanks,

Shauna

Leave a Reply